Introduction

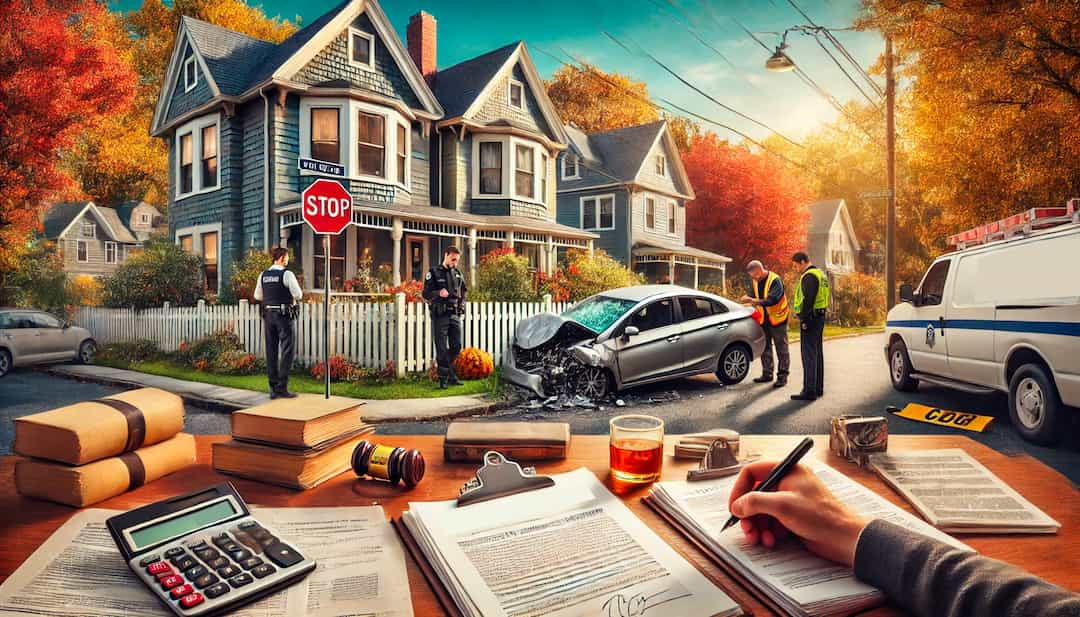

Understanding what property damage liability is, is vital for every driver, especially in a state like Florida, where drivers are required to carry specific insurance to protect against potential financial losses. Property damage liability is a key component of auto insurance that covers the costs if you cause damage to someone else’s property in an accident. Whether it’s another vehicle, a fence, or a building, this insurance ensures that repair costs are covered, preventing you from facing significant out-of-pocket expenses.

In Florida, property damage liability is crucial not only for financial protection but also for ensuring that affected parties receive timely compensation. This guide will walk you through the essentials of property damage liability in Florida, including the required coverage, how to file a claim, and tips for maximizing your coverage.

Understanding Property Damage Liability in Florida

What is Property Damage Liability?

Property Damage Liability is a fundamental part of auto insurance in Florida that covers the costs of damage you cause to another person’s property in an accident. This could include other vehicles, fences, buildings, or any other property damaged in an incident where you are at fault. In Florida, this coverage is mandatory, making it essential for all drivers to understand how it works and why it’s necessary.

Key Features and Importance

Property damage liability protects you from significant financial loss if you are at fault in an accident. Imagine causing thousands of dollars in damage to someone’s car or home; without property damage liability, you would be personally responsible for covering those costs. This insurance ensures that your assets are protected, and the affected party is compensated promptly. In Florida, carrying property damage liability is not just recommended—it’s required by law.

Florida State Requirements

According to the Florida Department of Highway Safety and Motor Vehicles, all drivers are required to carry a minimum of $10,000 in property damage liability coverage per accident. This ensures that any damage you cause is covered up to this limit, protecting both you and the other party involved. For more detailed information on these requirements, you can visit the Florida Department of Highway Safety and Motor Vehicles’ insurance page.

Coverage Details

What Does Property Damage Liability Cover?

This insurance covers a broad range of potential damages. From repairing another driver’s vehicle to fixing a damaged fence or structure, property damage liability ensures that you are not left financially vulnerable after an accident. It also covers legal fees if the other party decides to sue you for damages.

What is Not Covered?

While property damage liability covers damage to others’ property, it does not cover damage to your own vehicle or property. For that, you would need collision or comprehensive coverage. Understanding the limits of property damage liability is crucial to ensuring you have complete protection in the event of an accident.

Importance of Understanding Your Coverage

Many drivers in Florida may unknowingly select the minimum required insurance when purchasing a policy online or through an agent, often without fully understanding what is being covered. It is crucial to be aware that property damage liability will not cover any of your personal expenses or damages to your vehicle; it only addresses the cost of damages you cause to someone else’s property. Knowing this distinction helps drivers avoid unexpected out-of-pocket expenses after an accident.

Limits and Financial Protection

The limits of your property damage liability coverage dictate the maximum amount your insurance will pay out per accident. In Florida, the minimum requirement is $10,000, but many drivers opt for higher limits to better protect themselves. Knowing how property damage liability limits work can prevent you from facing out-of-pocket expenses that exceed your coverage.

How Coverage Limits Work

The property damage liability coverage limit is the maximum amount your insurance will pay for damages in a single accident. For instance, if your limit is $20,000 and the damage you cause is $25,000, you would be responsible for the additional $5,000. Understanding these limits is critical when choosing your policy; opting for higher limits can offer greater financial protection.

Risks of Underinsurance

Choosing only the minimum property damage liability coverage can leave you vulnerable to significant financial risks. If the damage exceeds your coverage limit, you could be responsible for paying the difference, which could be substantial. Understanding the risks of underinsurance is essential to ensuring that your coverage is sufficient to protect you from unexpected financial burdens.

Filing a Property Damage Liability Claim in Florida

Filing a property damage liability claim can be a straightforward process if you understand the necessary steps. Knowing what property damage liability is and how it functions in Florida is crucial when navigating the aftermath of an accident. This insurance coverage ensures that damages you cause to someone else’s property are taken care of by your insurance provider, up to the limits of your policy.

Steps to Take After an Accident

The first step after an accident is to ensure everyone’s safety and contact the authorities if necessary. Once immediate concerns are addressed, begin documenting the scene. Take clear photos of all damages and gather witness statements if possible. Accurate documentation is essential for a successful property damage liability claim.

Reporting and Documentation

Report the accident to your insurer as soon as possible, providing them with all the documentation you’ve collected, including photos, witness information, and a detailed account of how the accident occurred. Prompt and thorough reporting helps to streamline the property damage liability claim process and ensures you meet any deadlines set by your insurer.

Communicating with Insurers

Effective communication with your insurance company is key to a smooth property damage liability claim process. Be clear and concise about the incident and provide all requested information. Keep records of all communications, including emails and phone calls, to refer back to if any disputes arise during the claims process.

Need Help Navigating Your Claim?

If you’re facing difficulties with your property damage liability claim or dealing with insurance disputes, don’t handle it alone. Contact a Florida Car Accident Lawyer at LaBovick Law Group for expert guidance and dedicated support. Our experienced attorneys can help you secure the compensation you deserve and ensure that your rights are fully protected. Get a Free Consultation Today!

Maximizing Your Property Damage Liability Coverage

Understanding what property damage liability is, is essential, but knowing how to maximize your coverage is equally important. By ensuring you have the right amount of coverage, you can protect yourself from significant financial loss in the event of an accident.

How Much Coverage Do You Need?

Determining how much property damage liability coverage you need involves careful consideration of various factors. The minimum coverage required by Florida might not be enough to fully protect you. Assessing the value of assets you could potentially damage and understanding the risks you face on the road are critical in deciding how much coverage is necessary.

Factors to Consider

When deciding on the appropriate level of coverage, think about your driving habits, the area where you drive, and the potential costs of damages you could cause. High-traffic areas, expensive vehicles, and densely populated regions might require higher coverage limits to fully protect your financial interests.

Balancing Costs and Protection

While higher coverage limits mean higher premiums, they also provide more extensive protection. Weigh the costs of premiums against the potential out-of-pocket expenses you might face if an accident results in damages exceeding your coverage limits. It’s often worth paying a bit more to avoid significant financial strain later.

Tips for Reducing Premiums

There are strategies you can employ to keep your costs down without sacrificing the protection you need.

Safe Driving Discounts

Maintaining a clean driving record can help reduce your premiums, as insurance companies reward safe drivers with discounts.

Policy Bundling Options

Bundling your property damage liability coverage with other insurance policies, such as home and auto insurance, can also provide discounts.

Conclusion

In Florida, understanding what property damage liability is and its importance is essential for all drivers. It’s not just a legal requirement but a critical financial safeguard that can protect you from devastating expenses after an accident. By knowing how property damage liability works, how much coverage you need, and the steps to take when filing a claim, you can ensure that you are fully protected.

By taking advantage of discounts and bundling options, you can manage your property damage liability premiums effectively, making sure you have the right level of coverage at an affordable price. Make sure your property damage liability coverage is comprehensive and tailored to your needs, so you can drive with confidence in Florida.

FAQs related to ‘What is Property Damage Liability’

What is Property Damage Liability, and Why is It Mandatory in Florida?

Property Damage Liability (PDL) is a type of car insurance that covers the cost of damages you cause to another person’s property, such as their vehicle, fence, or building, in an accident where you are at fault. In Florida, this coverage is mandatory with a minimum requirement of $10,000. It is required by law to ensure that drivers are financially capable of compensating others for damages they cause, thereby preventing uninsured losses and lengthy legal disputes.

Does Property Damage Liability Cover My Car?

No, property damage liability only covers damage you cause to other people’s property. If you want coverage for your own car, you’ll need collision or comprehensive insurance.

What Happens if I Don’t Have Enough Property Damage Liability Coverage?

If the damage you cause exceeds your coverage limit, you’ll be responsible for paying the difference out of pocket. This is why it’s often recommended to carry more than the state minimum.

How Do Property Damage Liability Limits Work?

Your insurance policy will have a per-accident limit for property damage liability. For example, if your policy limit is $25,000 and you cause $30,000 in damage, your insurance will pay up to $25,000, and you’ll be responsible for the remaining $5,000.